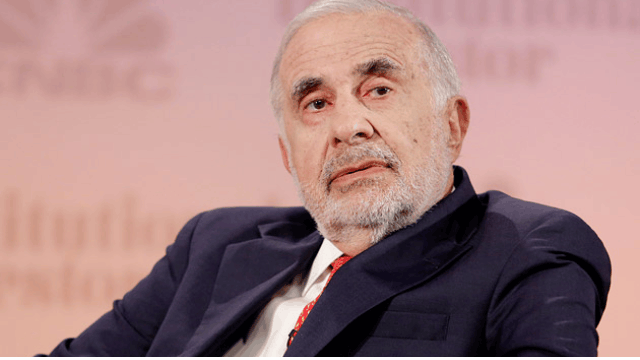

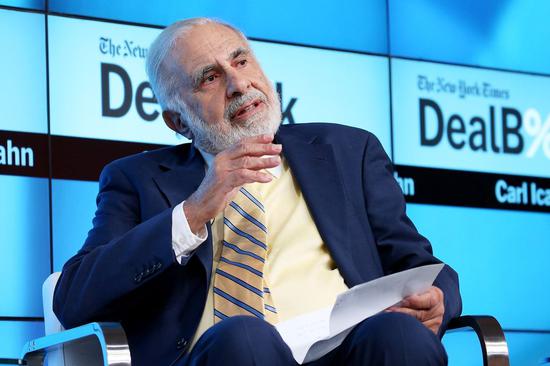

Carl Icahn was born in 1936 and grew up in Far Rockaway, Queens, New York City. His father was a synagogue usher and his mother was a school teacher. After receiving a degree in philosophy from Princeton University, Icahn attended New York University School of Medicine before dropping out to join the reserves. In the army, Icahn showed his talent for speculation and quickly became a well-known poker player. After six months in the army, Icahn opted for a discharge.

In 1961, Icahn officially took up a job as a stockbroker at Dreyfus, where he made a fortune from leveraged investments during the bull market, but it did not last long, and in 1962, the US stock market crashed and Icahn lost all his money overnight.

In 1978, Icahn made his first attempt to acquire Tappan, a manufacturer of home appliances. Icahn bought in bulk at $8 and eventually took on outside investors for $18.

At this time, he found another excellent opportunity. A long-established supplier of automotive parts and accessories, Pfeiffer. Icahn raised $80 million of his own money, plus leveraged finance, to buy the company. It was then transformed from an extremely chaotic company that "could not even produce accurate financial statements" to a modern, well-managed company.

At the beginning of 1985, Icahn again saw an investment in a company whose "fundamentals and share price were seriously at odds": Phillips Petroleum. Surprisingly, Icahn finally chose to abandon the acquisition and instead sold all his shares. Icahn managed to make a profit of hundreds of millions of dollars in a transaction that lasted less than six months.

In 1985, Icahn found a loophole in the shareholding structure of the newly split TWA, which required only 51% of the shares to be acquired, while the management, including the CEO, held only 1.1% of the shares.

Icahn was quick to buy up the shares at just $10, and when they reached the 5% disclosure threshold, Icahn quickly increased his stake to 16%, and Wall Street investors followed suit, sending the company's share price soaring to $19.

TWA's management sensed the crisis and filed a lawsuit in the New York courts. Icahn, however, fought the lawsuit while rapidly increasing his shareholding to over 52%, completing his absolute control.

Eventually, in 1988, Icahn owned 90% of the company through a management buyout and took TWA private. Icahn himself made a profit of approximately US$469 million and sold off TWA's most valuable London business for a further US$445 million.

In 2001 TWA was acquired by American Airlines and the old airline, founded in 1925, was retired from the airline's history.

Between 2000 and 2006, Icahn acquired four casinos and bought the Sky Tower Casino Hotel in Las Vegas for $300 million, selling it in February 2008 for $1.2 billion.

In 2006, backed by the wealthy United Arab Emirates, Icahn used billions of dollars to buy Time Warner, whose share price rose for six months afterwards, and Icahn sold his Time Warner shares for a profit of $880 million.

In October 2013, Motorola sold its mobile phone business to Google for a 63% premium. Icahn himself made a profit of $1.34 billion from the $12.5 billion deal.

In October 2012, Icahn bought a 10% stake in Netflix for $58. In total, Icahn made over $2.12 billion from Nifty, one of his most profitable deals.

Icahn's approach to investing

Unlike Warren Buffett's "buy the stock, buy the company" style of investing, Icahn is more of a "stocks over companies" kind of guy, with a sharp and aggressive investment style. Icahn prefers to hold his investments for a few years rather than forever than Warren Buffett's 'long term' approach.

He is more of a trader and usually cashes out as soon as he makes a good profit. We can summaries 5 of Icahn's investment characteristics.

1, low win rate and high odds. The American investor Brian Ritchie analyzed Icahn's investments from 1994 and deduced that his winning rate was only 58%, which is almost equal to the result of a coin toss. What he needs to ensure is that he does not lose too much on the stocks that lose and win more on the ones that win. Similar to Soros' operating philosophy.

2, Moderately concentrate your investments where you are sure you will win. Icahn is a lot like Warren Buffett when it comes to concentration. As you can see from his previous investments, Icahn has become wealthy throughout his career by concentrating his bets.

3, Be patient. Although Icahn is typically an activist, it does not mean he will make frequent trading moves. Ritchie's analysis says that Icahn's average holding period is over two years. Icahn has also revealed in interviews the "real secret" behind his success, which is that he once even held a stock for 31 years.

4, Don't be afraid to take risks or suffer losses. Over the past 20 years, Icahn has had a number of stocks that have lost money completely (i.e. down to zero). However, this has not been an obstacle to Icahn's progress, as he has a series of "big winners" that have made up for the losses. This is similar to Peter Lynch's 10x stock strategy.

5, Remain alert to changing conditions and adjust your portfolio. Icahn will remain alert to changing circumstances. His action on Apple is an example of this.

In terms of company selection, Icahn's favorite targets are heavily undervalued industry stalwarts. Icahn tends to look at companies that he believes have growth prospects, yet are currently not very well run.

So too, Carl Icahn gets involved early in a company, he buys the company's shares at a lower price and promotes internal restructuring and optimization.