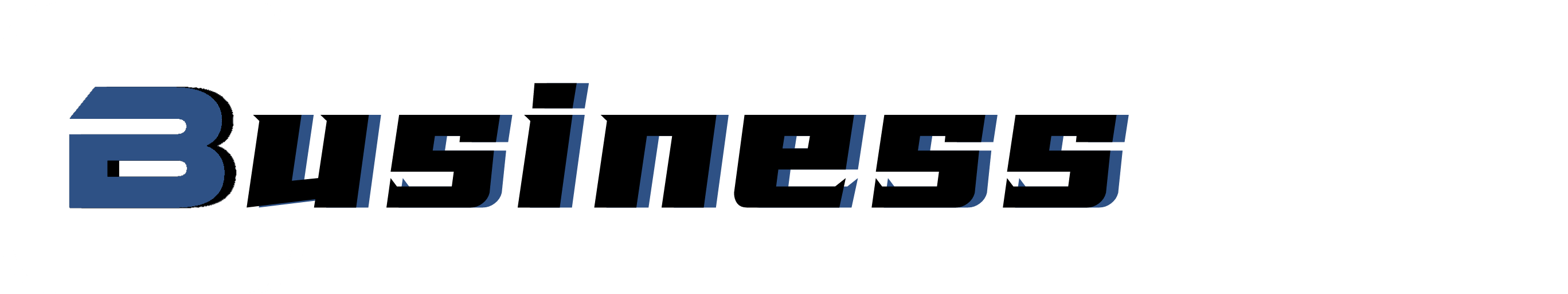

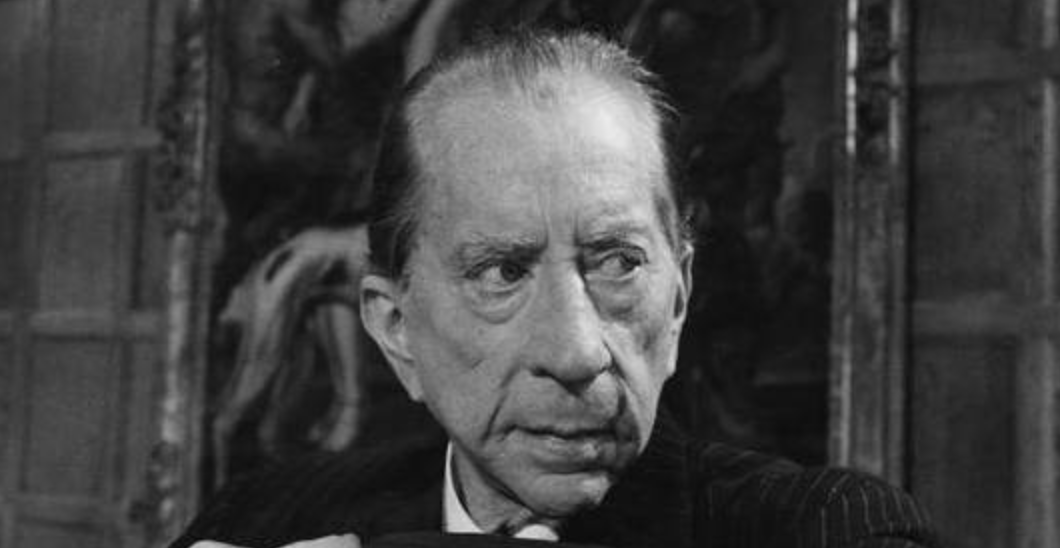

Paul Getty (15 December 1892 - 6 June 1976) - oil eccentric and the richest man in the world in the 1960s.

Given $500,000 by his father on his death in 1930, he spent the next 20 years battling to expand his power in the stock market and in the oil world, becoming the richest man in America in 1953 after accumulating $1 billion in less than three years as a result of a successful well on the Kuwaiti border, a position he maintained for the next 20 years until the Arab countries nationalised their oil.

Starting with nothing

At the time, Getty had no capital, no expertise in geology or oil exploration, but only a little sense of what his father's oil business entailed. So, the start-up was extremely difficult, to say the least. However, he was confident that if others could do it, he could do it too. If you have faith, you can do what you want to do. The year passed quickly and Getty still hadn't made a penny until the winter of 1915, when the opportunity presented itself and Getty learned that a farm called "Nancy Taylor" was to be sold at public auction. He went there to see it and immediately decided that it must be rich in oil. He had his eye on the Nancy Taylor lease, but there were many other developers competing with him, all with more money and experience than him, so his hopes had to be dashed. But Getty had a little trick up his sleeve. It just so happened that a friend of his was a senior officer of a well-known local bank, so Getty asked the friend to bid on his behalf, which was a very good idea indeed, because the other developers thought that the senior officer represented a large and powerful company, and they all had loans with the bank, so they had to back off. So, after a lot of trouble, Getty was able to secure the land for just $500. After a lot of trouble, Getty finally bought it for $500. Getty set up a company to extract oil from the land. However, he no longer had the money to buy machinery to dig the well. Getty had to partner with his father, who invested in the machinery and took a 70% stake in the company. In this way, the Getty Oil Company was able to start digging wells.

In 1916, the first well dug by Getty on the Nancy lease produced oil and was capable of producing 720 barrels of crude oil a day. On the third day after the oil spurt, Getty resold it decisively. As agreed with his father, he received 30% of the resale profit - $11,850. Two weeks later, he sublet the land to another oil company and made a net profit of US$12,000 from it. This transaction strengthened Paul's belief in the oil industry and that he could make more money. From there, he began to run oil as his own business. By the time he was 24, Getty was a millionaire.

Building the Getty empire

During the First World War, the price of oil in the United States nearly doubled. The Gettys' fortune ballooned with it. Paul was still living in a hotel in Tulsa with a group of oil diggers. It was like a New York stock exchange, bustling with oilmen gathering information about the price of oil and oil mines and exchanging information about the sale of leases. Paul was able to make a substantial profit as a lease broker and expand his leases at the same time.

Vision

At the time, few oilmen realised the practical value of geology in oil exploration, and they drilled wherever there was oil, based on their own experience and senses and with a certain blindness. Unlike those, Paul heeded the advice of geologists and turned his attention from the highly competitive areas to the untouched red clay north and west of the Cushing field. It was not long before he discovered the Garber and Billings fields there.

Young retirement

Just five months later, he found himself with $1 million in assets. A millionaire at the age of just 24, Paul was confident that he would have enough to last him a lifetime and decided to 'retire'. He wanted to leave his job behind and have fun and enjoy himself.

Back on the road again

In late 1921, the Gettys made a decisive move by buying a piece of mountain land near Santa Fe Springs for $693. By 1923 the land was producing over 70 million barrels of oil a year and over the next 15 years had generated a value of $6.4 million - a real profit! Paul attributed this to him, claiming that if he had not selected the land, the family would have made nothing in the 1920s.

When George Sr. died in 1930, he left his wife Sarah a $10 million estate and gave control of it to the appointed executor and his deputy; Paul received only $500,000 of the estate. This was certainly a heavy blow to Paul Getty as it prevented him from further flexing his muscles.

Ambition after the Great Depression

The 1930s saw the Great Depression in the US economy and the collapse of the stock market. While most investors and businessmen retreated and took refuge, Getty bucked the trend and decided that this was the perfect opportunity to develop his talents and create a major oil conglomerate.

At the time, the shares of many oil companies had fallen to a fraction of their original price, and stockholders continued to sell off. Getty had his eye on two Californian oil companies, United Mexican Seaside and Pacific Western, which owned valuable land in the Kettleman Hills oil field. Pacific Occidental in particular was worth $3 per share but the market price was only $0.40. But his mother, Sarah, objected to the purchase of the stock, so Getty went around her and managed to persuade the company's directors to buy $3 million of stock with a loan.

But the severe market downturn saw the share price fall even to $0.09. The fall in the share price at the time put a great deal of pressure on Paul, whose mettle and fortitude were tested as never before during this period, and for which he had to abandon Seaside Union Oil to concentrate on Pacific Occidental. He had this to say, "If this fails, I will be penniless and have nothing left." And in order to take full control of his stake in Pacific Western Oil, by 1931 he had used up his entire savings.

Finally, his mother, who held a great deal of money, loosened her tight grip and gave her son assistance to help Paul through the difficult times. By this time, Seaside Oil was controlled by the oil giant of the time, Mobil, and Paul showed his great courage and endurance in the face of the giant's challenge. He took the whole world by surprise!

At first, Paul, who had fought Mobil for several rounds, was always on the losing side, but he was undaunted and waited for his chance. in 1934, US President Roosevelt wanted to review the most powerful family estates in the country, and as Mobil's largest shareholder - Rockefeller - had to confess all his shares, and in order to avoid the high in order to avoid high estate taxes, Rockefeller decided to sell a portion of his shares. Paul did not miss this opportunity and, through a friend, he was able to obtain Rockefeller's 10% share in Seaside.

This was just the beginning, and over the next 10 years or so Getty continued to expand his stake, and by the early 1950s all but one of the directors on the board of directors of Seaside Consolidated Oil Company were under Getty's shareholding, which meant that Getty was by then in full control of the company.

The move to the Middle East

At the end of the Second World War, Paul, who had made a fortune in the war, was almost 60 years old, but his ambition was undiminished. He had a keen sense that the future of oil development should be the Middle East, that it would be the future oil depot of the world, and that the Getty family's future depended on it. He wanted to develop oil in the Middle East and refine it in refineries in the USA. But at that time the Middle East was already controlled by seven major companies, including BP, Royal Dutch Shell and Mobil Oil, and it was difficult to break in.

No one would have thought that Getty would end up looking at a barren patch of land between Saudi Arabia and Kuwait, a vast desert that was part of a neutral zone shared by both countries. Getty's petroleum geologists flew in to observe the terrain from the air and concluded that there was oil buried underneath. After negotiations, Getty was awarded a 60-year oil concession, but he had to meet the rather harsh conditions imposed by Saudi Arabia and take great risks. Many in the US oil industry publicly pointed out that Getty was doomed to bankruptcy by doing so, believing that there was no chance of oil ever being produced there.

Getty, however, was confident and dared to do so because he believed that oil was cheap to extract in Saudi Arabia and, given the rising price of oil, he was certain that the land would be profitable in the long run.

Over the course of four years, Getty invested $40 million, but only produced a small amount of poor quality oil. This oil was difficult to refine and had little commercial value. The predictions of the oil industry seemed to have been borne out and even Getty himself was showing signs of restlessness - after all, he was not getting any younger.

However, after four years of constant frustration, success came unexpectedly, and on 10 February 1953, oil-bearing sands were discovered on this unpromising land, and then oil began to spill out. This discovery turned the Getty's fortunes around so completely that American magazine Happiness called it "great and historic". One by one, highly productive wells were drilled and within a month, Getty's stock soared from $23.75 to $47.75 and Getty's fortune began to grow exponentially again.

According to conservative estimates by petroleum geologists, the Getty's Neutral Zone fields held more than 13 trillion barrels of oil. In response, Getty built and purchased refineries all over the region, and from 1954 onwards began building his fleet of supertankers, and in Los Angeles and New York he built new office buildings worth over $40 million at an astonishing rate. by 1957, Getty's assets exceeded $1 billion. That year, when Destiny magazine listed the richest people in America, Getty topped the list.