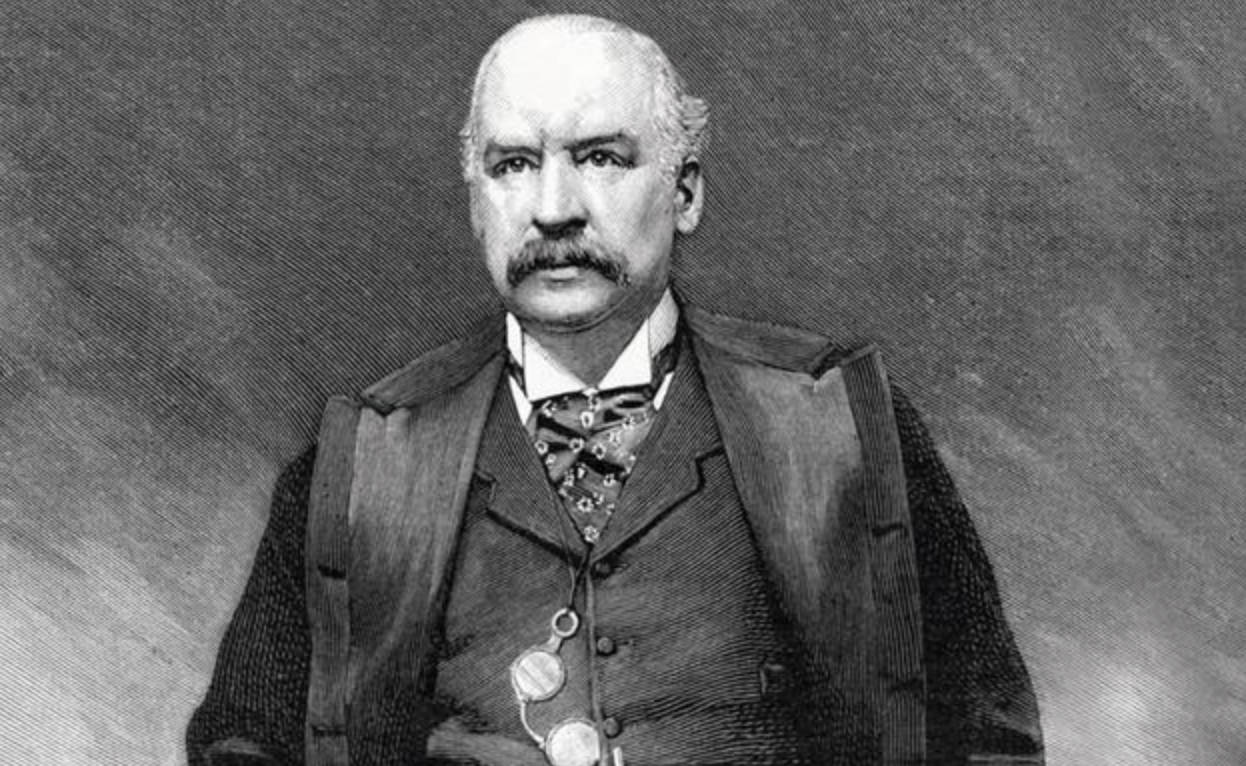

John Pierpont Morgan Sr. (17 April 1837 - 31 March 1913) was an American banker and art collector.

Morgan founded the Morgan Mercantile Company in 1861; put together the merger of the Edison General Electric Company and the Thomson-Houston Electric Company in 1892 to form the General Electric Company; and formed the United States Steel Corporation in 1901.

Hard work

In 1857, Morgan travelled to New Orleans and made his first fortune in the coffee business.

In 1861, Morgan founded the Morgan Mercantile Company.

In 1871, Morgan's partner, Charles Dabney, retired and their partnership was dissolved. With the help of his father, Morgan teamed up with the Drexel family and partnered to open Drexel Morgan & Company, the forerunner of J.P. Morgan & Co.

In 1873, Cook, the Seligman consortium of Wall Street and the Rothschild consortium of Europe joined forces. to obtain a $300 million debt service financing bond issue against a strong challenge from Drexel Morgan, J.S. Morgan, Morton Bliss and Baring Brothers. In this extremely competitive market, the Morgan syndicate leapt to a dominant position in federal financing.

In 1892, he brokered the merger of the Edison General Electric Company with the Thomson-Houston Electric Company to become General Electric.

In 1901, Morgan went on to merge the Carnegie Steel Company and several steel companies; on 1 April, U-S-Steel was declared official.

World debtors

The American Civil War

In 1861, as the American Civil War progressed, the US federal government was in serious financial crisis. The federal government decided to issue $400 million in public debt in order to stabilise the deteriorating economy and to pay for the purchase of weapons. Sensing once again that this was an opportunity to make a fortune, Morgan agreed to underwrite the US$200 million Treasury bond issue.

After assuming the issue of treasury bonds, Morgan did not rush into the issue, but first made some preparations. He made frequent appearances on various occasions to express his views on the trend of the US economy and the changes in the war situation, in order to make the public understand the benefits of buying treasury bonds through the press.

The conditions were ripe for Morgan to take action. He travelled from state to state, using patriotism to appeal to everyone to contribute to the fate of the nation and the country. This campaign enabled Morgan to complete the issue of $200 million in treasury bonds. As a result, Morgan became a hero in saving the American economy, while receiving a handsome profit.

The Panic of 1907

In 1907, an economic panic broke out in the United States. There was no central bank and no strong force to stabilise the markets. Half of New York's bank loans were bet on risky stock markets and bonds by trust and investment companies, who earned high rates of return, and the financial markets were in a state of extreme speculation. The rash actions of the Trust and Investment Companies caused a major panic on Wall Street and talk of their imminent bankruptcy was rife. The bankers withdrew their loans, the stock market fell into disarray, many banks were on the verge of collapse and a financial crisis ensued.

When the chairman of the New York Stock Exchange came to Morgan's office for help, Morgan sent someone to the Stock Exchange to announce that interest on borrowing would be available at an open rate of 10%.

On 2 November, J.P. Morgan began a plan to "bail out" Mooresley (a major creditor of the Tennessee Mining and Iron Company), which was on the verge of bankruptcy with $25 million in debt; if Mooresley was forced into bankruptcy to pay its debts, the New York stock market would collapse completely. JPMorgan bought Tennessee Mining and Iron for the ultra-low price of $45 million, while the potential value of the company was assessed by John Moody's to be at least $1 billion.

Once again, Morgan emerged as a hero in this crisis. Although there was a personal profit motive involved, Morgan's role in the recovery from the economic crisis was significant; some have called Morgan's act "for-profit patriotism".

The Mexican deficit

In 1898 it was revealed that the Mexican government was on the verge of bankruptcy due to its inability to repay old debts to the Spanish government. The Mexican government had to issue public debt to pay it off. The Mexican government was planning to issue $110 million in bonds to tide them over.

Morgan thought that if he could help the Mexican government at a difficult time, he would not only gain goodwill and lay a good foundation for future cooperation, but he would also be able to improve his own terms. In Morgan's view, this was a double whammy rather than a bad thing, and besides, the political situation in Mexico was in a relatively stable state. With these ideas in mind, Morgan immediately joined forces with the German banks to assume the public debt issued by Mexico. This time, the assumption of the Mexican public debt, the condition is that the Mexican government must use the Mexican oil mines and railways as a guarantee, this condition is undoubtedly very favorable to JPMorgan. This subscription to Mexican bonds was extremely profitable for JPMorgan in both the short and long term.

The Paraguayan War

After the war with Paraguay in 1864-1870, Argentina was badly wounded and by the 1890s was in economic crisis. The London firm of Harlem bought a large amount of Argentine bonds against the vast land mass of Argentina and made a considerable profit, however, due to financial constraints, it was unable to take on all the bonds issued by the Argentine government. The Argentine railways had great potential, the cheese products were world famous, and although the government was corrupt, it was respectful of foreign capital, and the fall of such a government would not be good for future development in South America. So Morgan bought $75 million of Argentine government bonds.

The Second Boer War

Between 1899 and 1902, due to the protracted nature of the Second Boer War, the cost of the war to Britain far exceeded the original estimates. While the British army was being held back, the German Emperor, who had always been inimical to Britain, was ambitiously building a fleet to replace Britain's naval supremacy. As a result, Britain was actively expanding its military equipment at sea. With the enemy at her back, Britain's finances were in dire straits and she had to turn to the outside world for help.

On 31 March 1913, John Pierpont Morgan died suddenly at the age of 76 while on a trip to Cairo, Egypt.

Pierpont was a troubled young man: a chronic sufferer of headaches, intermittent fainting spells and skin rashes; an on-again, off-again relationship with his father, the banker Julius Morgan; and the lifelong trauma of his first wife's death four months after their marriage. But as he grew older, he became stubborn and convinced of every sudden thought that came into his head. However, his idealistic side still shows through: if the business problems he faces offend his inner sense of morality, his conservative bone stirs up his passion for change.

Such was Pierpont's paradoxical growth into a shrewd businessman - through a financial institution, John Pierpont Morgan achieved an extension of his personal influence. From Morgan's grandfather, Joseph, to his father, the Morgan family was successful in business. Perhaps it was because of this special family atmosphere and business upbringing that Morgan was a daring, adventurous and speculative businessman from a young age. (Review of The History of the 100 Richest People in the World)

Morgan's death marked the end of an era on Wall Street, and there would be no successor to Morgan. A new era of one-man rule on Wall Street has become unattainable. (Wall Street Journal review)

Morgan created a vast empire in the JPMorgan system, with 167 JPMorgan directors controlling the entire JPMorgan system. Carrying out Morgan's directives from Wall Street, JPMorgan is literally the nerve centre of Wall Street. (Review of Lifetime Advice for Young People from the World's Richest People)